Is the SMART Trial a Game Changer for TAVR?

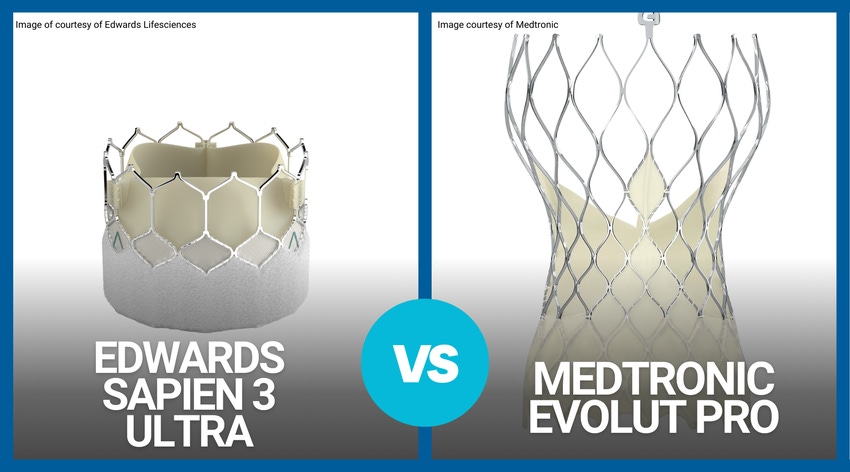

Analysts discuss the potential impact of a clinical trial that had Medtronic’s Evolut technology go head-to-head with Edward’s Sapien platform.

April 10, 2024

At a Glance

- Study shows the Evolut TAVR platform may outperform the Sapien platform, particularly in patients with small aortic annuli.

- Analysts have concerns regarding the rate of bioprosthetic valve dysfunction recorded for the Sapien valve.

- Questions remain on how this study will change the TAVR market.

Edwards Lifesciences has had the lion’s share of the transcatheter aortic valve replacement (TAVR) market. This is partially because the Irvine, CA-based company pioneered the space and has had a much longer runway than its competitors.

But could results from a new clinical study begin to turn the tide in favor of one of Medtronic, one of Edwards’s chief rivals in the space?

Several medtech analysts weighed in on the SMall Annuli Randomized To Evolut or SAPIEN (SMART) Trial that was presented at the American College of Cardiology Annual Scientific Session this past weekend.

But first - in plain terms, the SMART trial showed Medtronic’s Evolut TAVR platform outperformed Edwards’s Sapien platform.

More specifically, one-year results of the SMART trial with small aortic annuli (SAA) demonstrated noninferior clinical outcomes and superior valve performance as measured by bioprosthetic valve dysfunction performance for the Evolut TAVR platform compared to the SAPIEN platform.

"SMART was launched to better understand how the two most commonly used TAVR systems perform in patients with small aortic annuli, and particularly in women who tend to have smaller heart valves," said Nina Goodheart, senior vice president and president, of Structural Heart & Aortic, which is part of the Cardiovascular Portfolio at Medtronic. "We continue to develop evidence to better understand the benefits of our Evolut TAVR technology in all patients, including patient populations that are underrepresented, under-diagnosed and under-treated. The results from the SMART trial demonstrate these benefits in a large patient population and reinforce our commitment to driving health equity and engineering the best technology to solve unmet patient needs."

.webp?width=700&auto=webp&quality=80&disable=upscale)

Medtronic's Evolut_PRO_TAVR_System

Digging into the Data

The trial randomized and treated 716 patients, 87% of which were women, across more than 80 sites worldwide. Eligible patients had a computed tomography aortic valve annulus area of ≤430 mm2 and suitable anatomy for transfemoral TAVR with both an Evolut PRO/PRO+/FX or a SAPIEN 3/3 Ultra valve.

Results demonstrated that the Evolut TAVR platform met both co-primary endpoints of clinical non-inferiority and hemodynamic superiority at one year.

Evolut TAVR met non-inferiority for the clinical outcome primary endpoint, a composite of all-cause mortality, disabling stroke, or heart failure rehospitalization at one year (9.4% Evolut vs. 10.6% SAPIEN, p<0.001 for non-inferiority).

Evolut TAVR demonstrated superiority for the valve function primary endpoint, bioprosthetic valve dysfunction through one year (9.4% Evolut vs. 41.6% SAPIEN, p<0.001 for superiority).

In an emailed statement to MD+DI, Edwards wrote, “The 1-year outcomes reported in the Medtronic-led SMART study, which was not an FDA approved trial, do not reflect contemporary experience in clinical trials or real-world evidence with the Edwards SAPIEN 3 TAVR platform. Data presented at TCT 2023 demonstrated excellent durability for both Medtronic and Edwards TAVR valves at 4 and 5 years which should be reassuring to patients and their physicians.”

Unleash the Analysts

Robbie Marcus, an analyst with JP Morgan, gave insight on whether this would move the needle for Medtronic’s TAVR efforts.

“While the headline reads positive for Medtronic, we don’t expect today’s results to shift clinical practice or TAVR share and could actually lead to a relief rally in Edwards shares, in our view,” Marcus wrote in a research note.

The biggest sticking point for most analysts was the rate of bioprosthetic valve dysfunction (BVD) that was reported being found in the Sapien valves.

Marie Thibault, an analyst with BTIG, noted that some of the trial results were a bit surprising. She also noted that she didn’t foresee a huge shift in market share because of the data.

“This was largely expected by investors, but we were surprised by the magnitude of statistically significant superiority related to bioprosthetic valve dysfunction (BVD),” Thibault wrote in a research note. “We think the SMART results will generate buzz and discussion but that large market share shifts are unlikely. We would expect that as with any trial results, any shifts are likely to be smaller and more gradual as doctors do their own diligence and centers consider their protocols.”

Margaret Andrew, an analyst with Willaim Blair characterized the SMART results as one of the more “controversial debates” of the ACC weekend.

“While the hemodynamics benefits in Evolut were largely as expected, the Sapien arm showed significantly higher rates of BVD than what we have seen historically in years of clinical data on the Sapien platform,” Andrew wrote. “However, we also heard clinician concern about the misuse of definitions in the trial such as deterioration defined above 20 mmHg and nearly 30% of Evolut valves being 29 mm (i.e., not “defined” as small annulus patients and therefore could have led to discrepancies). We believe this data will continue to raise questions among clinicians, as it has already this weekend, and may lead to limited share shifts in the coming quarters. That said, Edwards has remained the market leader and clinically supported performance in its Sapien platform, which we expect to continue.”

Danielle Antalffy, an analyst with UBS, wrote that the degree of disparity with the level of valve dysfunction was likely to raise questions.

“Still, the level of valve dysfunction with Edwards is "perplexing" as one physician hosted by Edwards noted, given the obvious point that if in fact Edwards's valves had such a high level of BVD, not only would Edwards not have been able to retain ~70% market share for the past decade but also the TAVR market wouldn't likely be the ~$5B global market that it is today. Because of this discrepancy vs. what seem to be real-world results and what's been shown in other clinical trials, we remain of the view that this trial won't meaningfully change practice.”

The Current TAVR Landscape

Edwards won FDA approval for the first generation of the Sapien valve in 2011.

Medtronic’s entry point into the TAVR market was through its acquisition of CoreValveabout 15 years ago.

Since the deal – other companies have populated the market. In 2019, Boston Scientific won a nod from FDA for its Lotus Edge device. However, the Marlborough, MA-based company retired its entire Lotus platform in 2020, citing complexities with the product delivery system.

Boston Scientific went on to focus on its Acurate neo2 TAVR system. Abbott Laboratories has developed the Navitor transcatheter aortic valve implantation system. The system won CE mark in 2021 and FDA approval in January of 2023.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)